DrapCode for Auto Lending Software

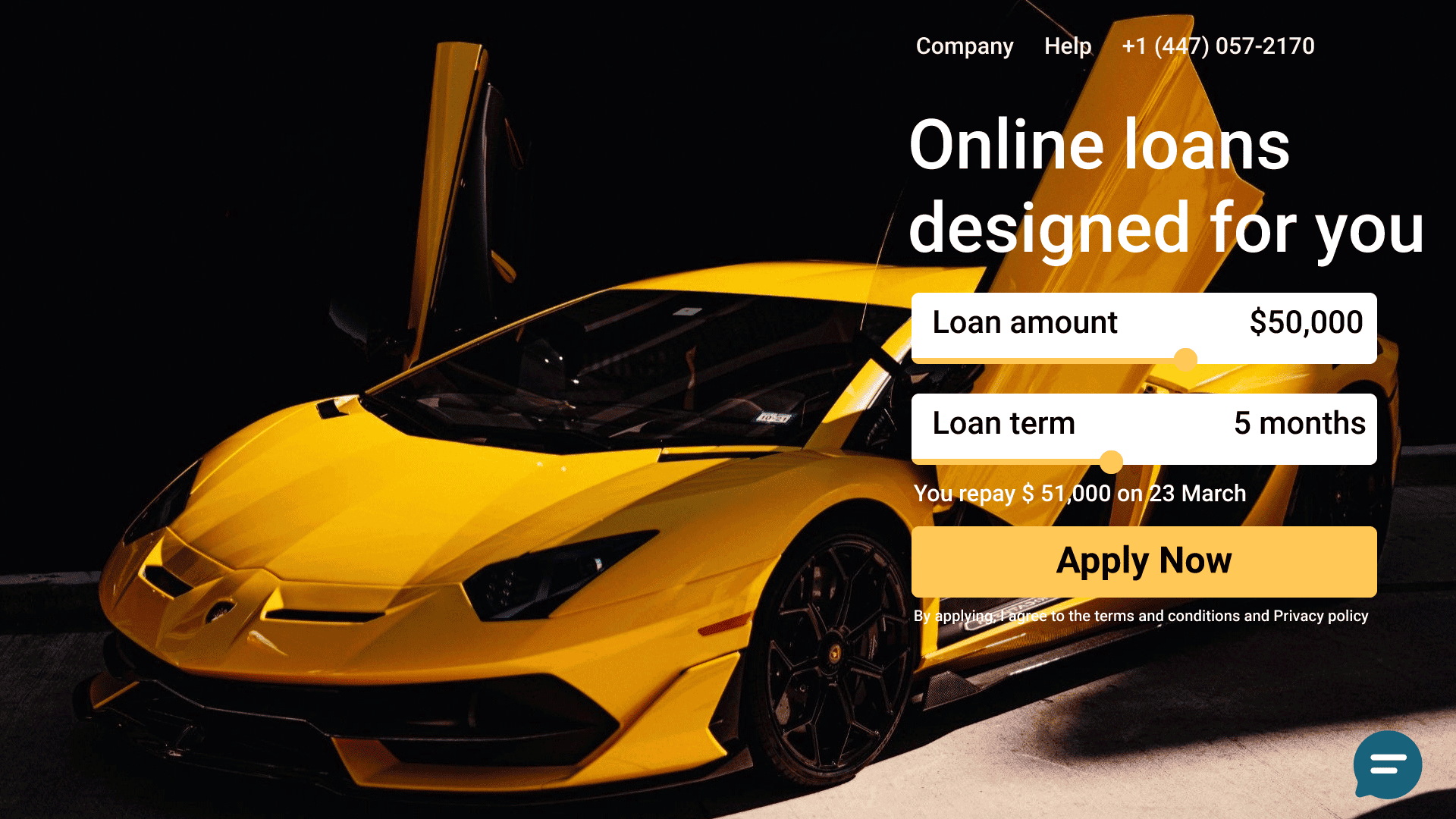

Build Auto Lending Software

Build, Customize, and Scale Your Ideal Auto Lending Software - No Coding Required!

Auto Lending Software

DrapCode's auto lending software empowers auto lenders to build efficient, tailored solutions for managing loans. With our visual development Software, streamline loan origination, simplify payments, and enhance customer experiences without the need for coding expertise.

Customizable Auto Loan Software

Create auto loan software that automates processes such as loan application review, credit checks, and approval workflows. DrapCode's Software ensures accuracy and speeds up loan processing for both lenders and borrowers.

What You Can Achieve

Experience the innovation in Auto Lending Softwares with DrapCode's key features. From simplified application creation without coding to real-time analytics. Our Software provides a comprehensive suite for optimal Auto Lending experiences.

Borrower Access Portal

Secure portal for borrowers to apply for loans, track application status, and manage loan accounts online.

Lender Access Portal

Dedicated portal for lenders to review auto loan applications, monitor investments, and manage lending portfolios efficiently.

Loan Application Processing System

Automated system to process auto loan applications, perform credit checks, and verify borrower information swiftly.

Credit Score Integration

Seamless integration with credit bureaus to retrieve and evaluate credit scores during the loan application process.

Pre-Approval System

System for borrowers to get pre-approved for auto loans, providing better leverage when negotiating car purchases.

Loan Management Dashboard

Comprehensive dashboard for borrowers and lenders to monitor loan performance, repayment schedules, and financial metrics in real-time.

Document Upload and Verification

Secure module for uploading, storing, and verifying essential documents such as income proof, ID, and financial statements.

Alerts and Notifications

Real-time alerts and notifications for important events like application status updates, payment due dates, and new offers.

Mobile App Integration

Mobile app providing borrowers and lenders access to all Software features on-the-go, ensuring convenience and flexibility.

Advanced Auto Loan Origination Software

DrapCode provides tools to develop auto loan origination software that manages everything from customer onboarding to loan disbursement. Customize your Software to meet your unique business needs while maintaining compliance.

Car Dealer Finance Software

Build car dealer finance software to support dealerships with financing solutions. Automate funding requests, integrate with credit systems, and track financial transactions seamlessly through DrapCode.

Gateway Auto Lending Made Easy

DrapCode's Software supports gateway auto lending by enabling smooth integrations with payment gateways, credit bureaus, and other financial systems. Simplify complex lending operations with a user-friendly interface.

Use Cases

New Car Purchase Loan

Apply for financing to buy a new car. Submit application online, receive approval, and manage loan terms conveniently.

Used Car Purchase Loan

Secure a loan for purchasing a used car. Quick application, fast approval, and track payments online.

Refinancing Existing Auto Loan

Lower interest rates by refinancing your existing auto loan. Submit details, receive offers, and manage the new loan online.

Auto Lending Software Providers

As one of the top lending software providers for auto lenders, DrapCode offers scalable and secure solutions. Develop Softwares that optimize operations, reduce manual errors, and enhance borrower satisfaction.

Get Started Today:

Ready to revolutionize your Auto Lending experience? Begin

your journey with DrapCode today.