DrapCode for Consumer Lending platforms

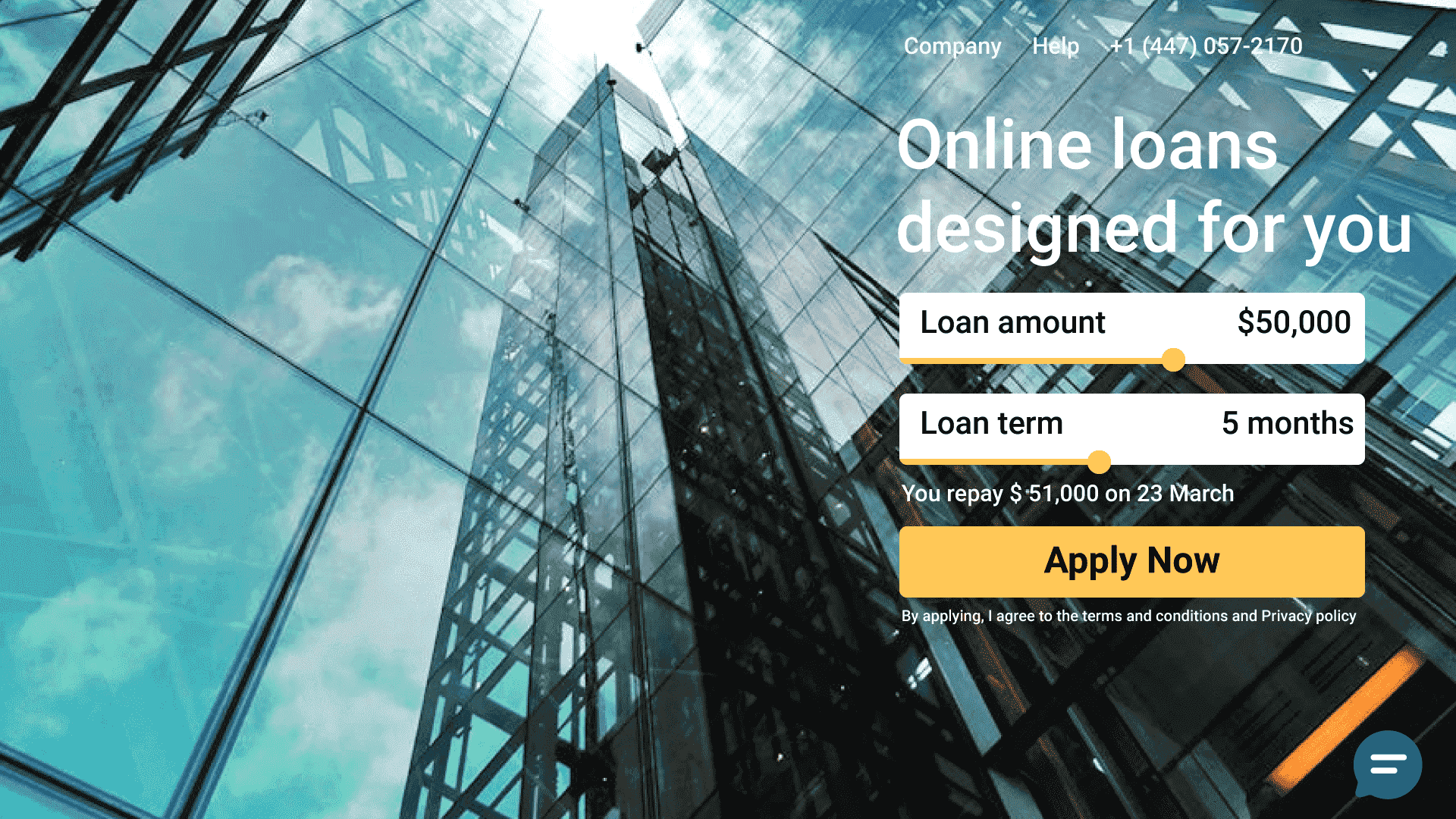

Build Consumer Lending Platforms

Build, Customize, and Scale Your Ideal Consumer Lending Platform - No Coding Required!

Build Consumer Lending Platforms

DrapCode’s consumer lending platforms enable businesses to develop customized lending solutions without coding. Create portals that streamline loan processing, improve customer experience, and ensure scalability to meet business demands.

Advanced Consumer Lending Software

Leverage DrapCode’s consumer lending software to automate loan origination, verification, and approval processes. With built-in tools for compliance and analytics, you can manage loans efficiently and securely.

What You Can Achieve

Experience the innovation in Consumer Lending platforms with DrapCode's key features. From simplified application creation without coding to real-time analytics. Our platform provides a comprehensive suite for optimal Consumer Lending experiences.

Borrower Access Portal

Secure portal for borrowers to apply for loans, track application status, and manage loan accounts online.

Lender Access Portal

Dedicated portal for lenders to review loan applications, monitor investments, and manage lending portfolios efficiently.

Loan Application Processing System

Automated system to process loan applications, perform credit checks, and verify borrower information for swift approval.

Credit Score Integration

Seamless integration with credit bureaus to retrieve and evaluate credit scores during the loan application process.

Loan Approval System

Automated decision-making engine for fast and accurate loan approvals based on predefined criteria and credit assessments.

Payment Scheduling

Tools for borrowers to schedule payments, set up auto-pay, and receive reminders to avoid missed payments.

Document Upload and Verification

Secure module for uploading, storing, and verifying essential documents such as income proof, ID, and financial statements.

Alerts and Notifications

Real-time alerts and notifications for important events like application status updates, payment due dates, and new offers.

Mobile App Integration

Mobile app providing borrowers and lenders access to all platform features on-the-go, ensuring convenience and flexibility.

Automate Lending Operations

Design an automated consumer lending platform that reduces manual work and accelerates loan processing. From credit evaluation to fund disbursement, automate every step with DrapCode’s no-code technology.

Seamless API Integration

DrapCode supports consumer lending platforms with APIs, enabling seamless integration with third-party services like payment gateways, credit bureaus, and customer verification systems. Ensure a connected and efficient lending ecosystem.

Use Cases

Mortgage Loan Pre-Approval

Streamline your home-buying process with mortgage pre-approval. Submit financial details and documents online, receive pre-approval letters.

Student Loan Refinancing

Refinance student loans for better rates. Compare loan offers, submit applications, and manage the refinanced loan with features like payment tracking, automatic payments, and customer support.

Auto Loan Application

Apply for an auto loan, get instant rate quotes, and manage the loan post-approval. Includes credit checks, digital confirmation, direct funds transfer, and payment scheduling.

Go Digital with DrapCode

Transform your business with a digital consumer lending platform tailored to your needs. Create user-friendly interfaces, offer secure transactions, and provide real-time updates to borrowers, all powered by DrapCode.

Get Started Today:

Ready to revolutionize your Consumer Lending experience? Begin

your journey with DrapCode today.