DrapCode for Loan Management Software

Build Loan Management Software

Build, Customize, and Scale Your Ideal Loan Management Portal - No Coding Required!

Comprehensive Loan Management

Efficiently manage the entire loan lifecycle with DrapCode’s loan management software, designed to support banks, fintech, and lending institutions in a digital-first environment.

Effortless Loan Management

Our no-code platform empowers you to create a fully customizable loan management system that streamlines operations, enhances borrower engagement, and ensures compliance. From loan disbursement to payment collection, DrapCode’s solution simplifies complex processes, enabling you to focus on what matters most—growing your lending business.

Key Features of DrapCode LOS Software

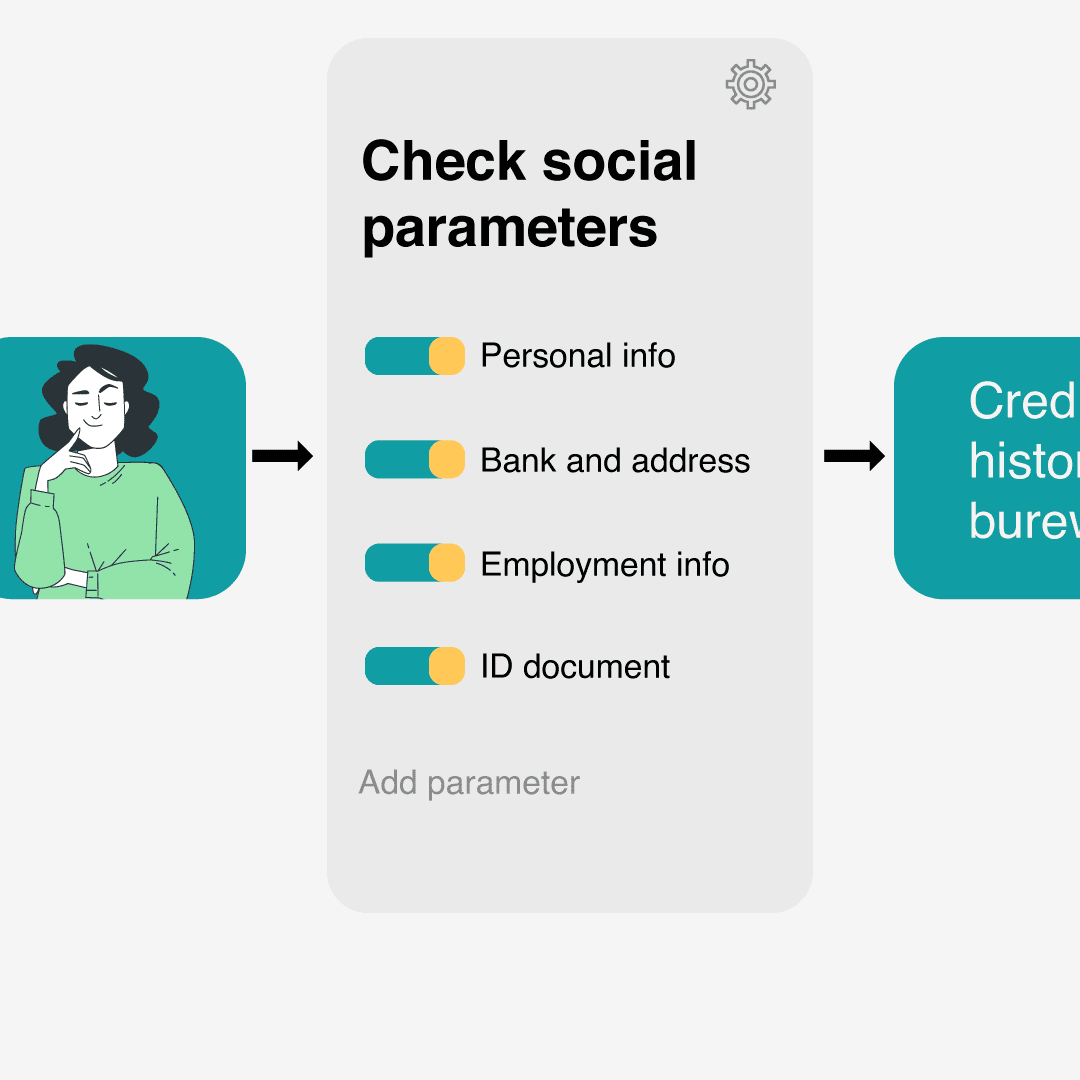

Real-Time ID Verification

Authenticate borrower identities in seconds, ensuring compliance with KYC and AML regulations to reduce fraud and streamline onboarding.

Automated Repayment Schedules

Set up automated repayment schedules to ensure timely payments from borrowers, reducing missed payments and improving cash flow.

Due Date Notifications

Send automated reminders to borrowers before their due dates, encouraging timely payments and reducing delinquencies.

Digital Loan Agreements

Create, share, and manage loan agreements digitally, ensuring accuracy and compliance with minimal paperwork.

Integrated E-Sign

Facilitate secure and quick signing of documents with integrated digital signature functionality, enhancing borrower convenience and compliance.

Sanction & Disbursement Letters

Generate custom sanction and disbursement letters to communicate approved terms and disbursement details efficiently.

Credit Bureau Reporting

Ensure compliance with industry standards through automated borrower data reporting to credit bureaus, fostering responsible lending.

Detailed MIS Reporting

Access insightful reports that help you analyze loan portfolio performance, track KPIs, and make data-driven decisions.

Transaction Reconciliation

Effortlessly reconcile loan transactions, ensuring accuracy and reducing the time spent on manual data verification.

Benefits of DrapCode’s Loan Management Software

Increased Efficiency Automate critical processes, reducing time and resources spent on manual tasks.

Enhanced Compliance Built-in features ensure your system adheres to lending regulations and standards.

Improved Borrower Experience Offer a seamless, fully digital loan application and management process.

Scalable and Flexible Easily adapt to changing business needs and scale your solution as you grow.

Data Security and Compliance DrapCode ensures robust security with encrypted data storage and compliance features, protecting sensitive borrower information.

Why Build Your Loan Management System with DrapCode?

With DrapCode’s no-code platform, you can quickly design a loan management system that meets your organization’s needs. Our visual, drag-and-drop builder allows you to configure and customize every aspect of your loan management process. This flexibility means you can adapt to changing business requirements and scale as you grow—without needing a developer.

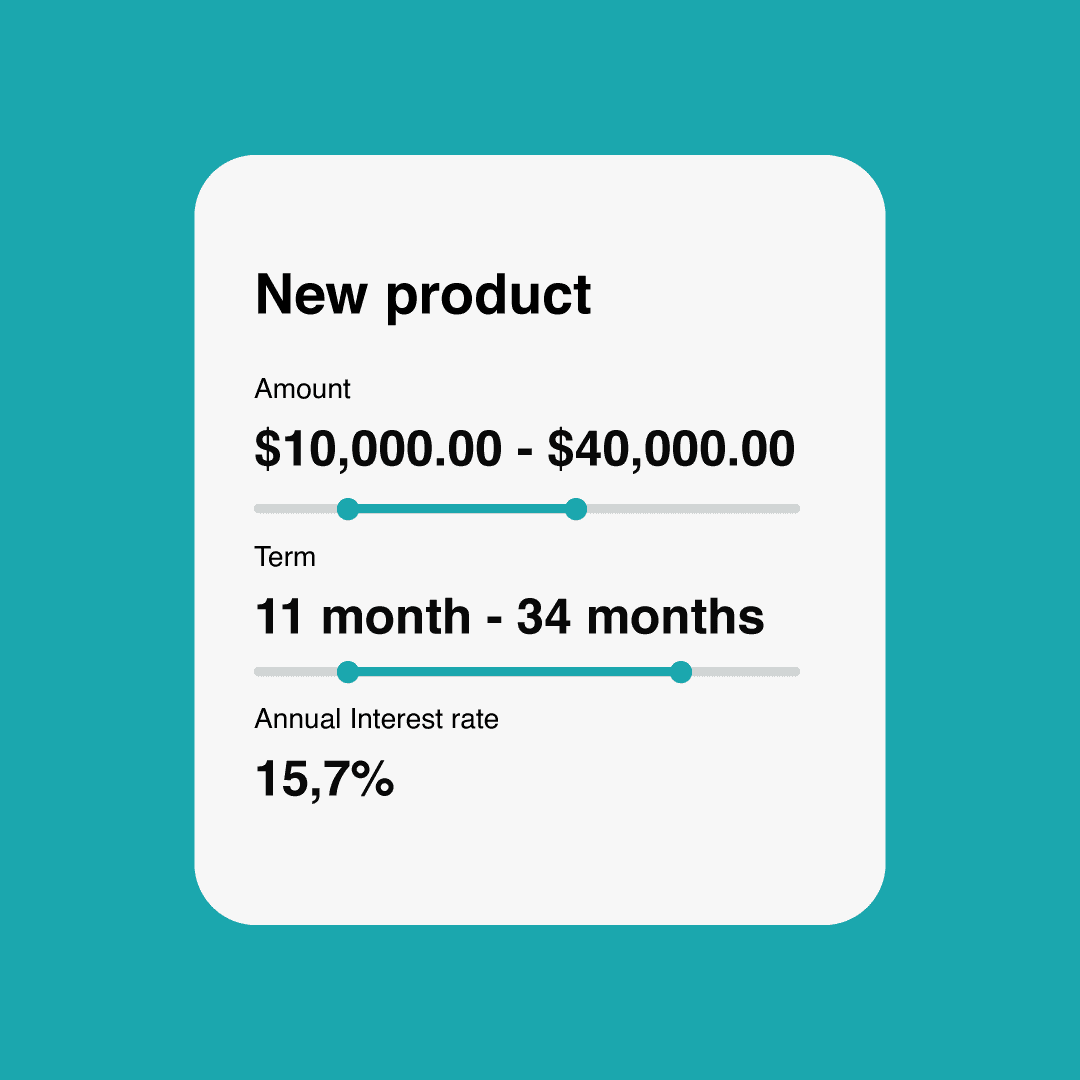

Visually Build LOS Platform

The no-code platform simplifies customization, enabling you to modify forms, templates, and data fields without requiring IT support or coding expertise. DrapCode’s platform ensures robust security, regulatory compliance, and streamlined integrations for efficient loan origination and management.

How It Works

Define Requirements

Use DrapCode’s builder to select the loan management features that align with your needs.

Customize & Configure

Add or modify modules like repayment schedules, notifications, and reporting to create a tailored experience.

Deploy

Launch your system with ease, ready to handle all aspects of loan management.

Optimize

Use real-time data and reports to refine your system and improve operations continuously.

Frequently Asked Questions

What is loan management software, and how can it benefit my lending business?

Can I customize the loan management software to fit my specific needs?

How does DrapCode ensure data security in its loan management software?

Does DrapCode’s loan management software support automated reminders for due dates?

How quickly can I launch a loan management system with DrapCode?

Get Started Today:

Ready to transform your Loan Management experience? Begin your

journey with DrapCode today.

Readymade Templates

Don't start from scratch! Use our pre-configured

ready-to-use responsive templates

and build your web apps faster.