DrapCode for Factoring Platform

Build Invoice Factoring Platform

Build, Customize, and Scale Your Ideal Factoring Portal - No Coding Required!

Invoice Factoring Software

DrapCode's invoice factoring software helps businesses manage cash flow by converting invoices into immediate funds. With a visually intuitive platform, streamline operations, reduce risks, and enhance financial efficiency without coding expertise.

Best Invoice Factoring Software for Businesses

Our best invoice factoring software offers customizable solutions for tracking invoices, managing clients, and automating payment collections. Simplify your workflow while ensuring secure and accurate financial operations.

What You Can Achieve

Experience the innovation in Factoring platforms with DrapCode's key features. From simplified application creation without coding to real-time analytics. Our platform provides a comprehensive suite for optimal Factoring experiences.

Client Access Portal

Secure portal for businesses to submit invoices, track factoring requests, and manage accounts receivable online.

Factor Access Portal

Dedicated portal for factors to review invoice submissions, approve funding requests, and manage investment portfolios efficiently.

Invoice Submission System

Automated system to submit, verify, and process invoices quickly, ensuring fast access to funds for businesses.

Credit Risk Assessment

Integration with credit bureaus to assess the creditworthiness of debtors, minimizing risk for factors.

Client Onboarding Module

Streamlined onboarding process for new clients, including identity verification, document submission, and account setup.

Factor Onboarding Module

Simplified onboarding for new factors, including profile creation, document verification, and initial investment setup.

Integration with Accounting Software

Seamless integration with popular accounting software to streamline invoice submission and financial reporting.

Receivables Management Dashboard

Comprehensive dashboard for clients and factors to monitor the status of invoices, track payments, and manage cash flow.

Payment Collection and Management

Efficient system for collecting payments from debtors, managing disbursements to clients, and tracking payment histories.

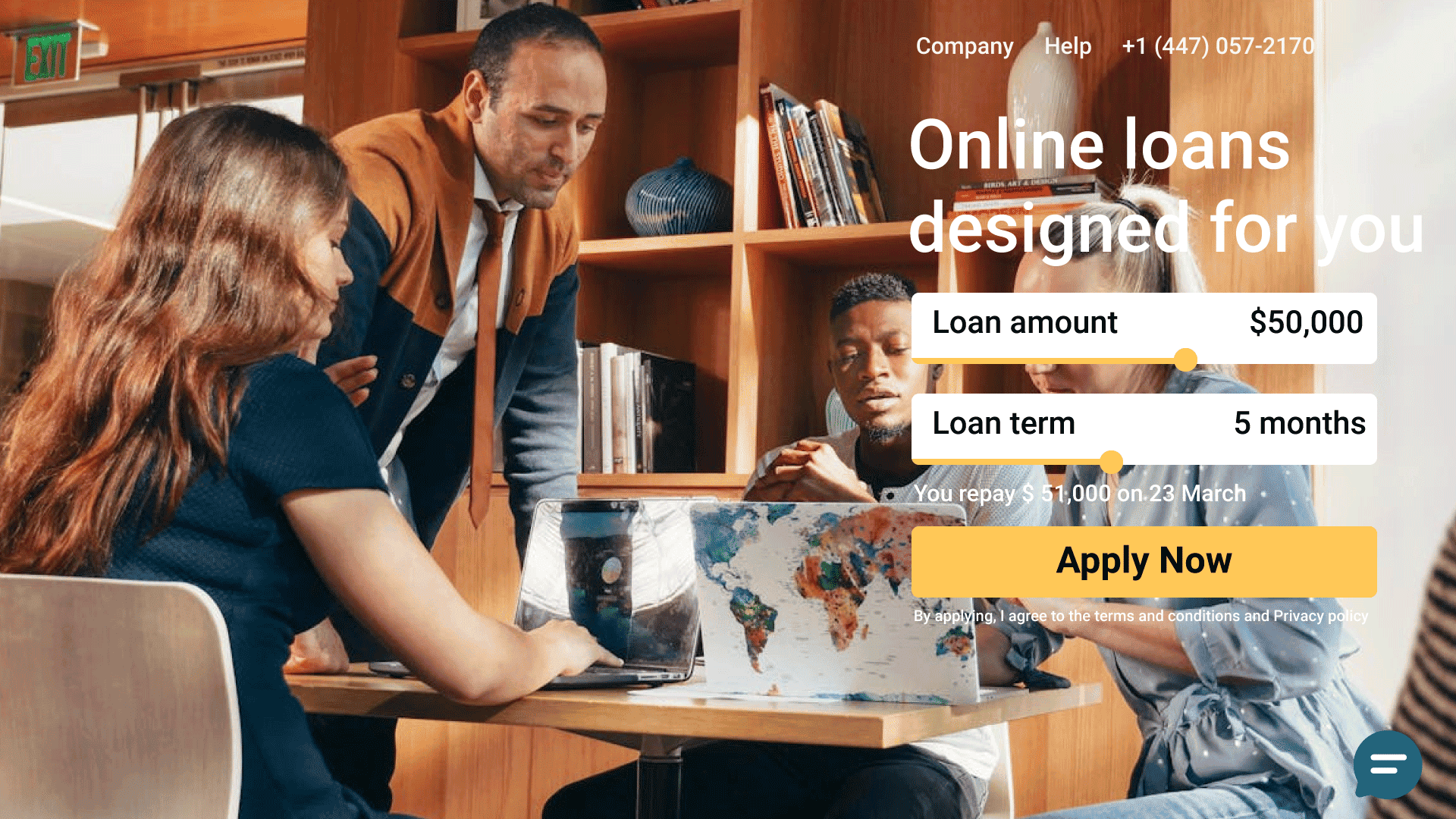

Automated Invoice Factoring Platform

Leverage DrapCode's invoice factoring platform to automate invoice management, funding approvals, and client communication. The platform reduces manual errors and ensures faster processing, saving you time and resources.

Streamline Invoice Operations

DrapCode empowers you to design tailored invoice factoring software that integrates seamlessly with your existing systems. Track transactions, monitor repayments, and generate real-time financial reports effortlessly.

Use Cases

Invoice Factoring

Sell unpaid invoices to get immediate cash flow. Submit invoices online, receive quick approvals, and track payments effortlessly.

Receivables Financing

Finance outstanding receivables for immediate working capital. Apply online, receive funds fast, and manage accounts receivable efficiently.

Selective Factoring

Choose specific invoices for factoring. Submit chosen invoices, get cash quickly, and manage remaining invoices independently.

User-Friendly Interface

Create an invoice factoring platform that is simple to use and enhances user experience. Provide your clients with an easy way to manage their invoices and funding requests through secure and intuitive portals.

Get Started Today:

Ready to revolutionize your Factoring experience? Begin your

journey with DrapCode today.